Uncovering The Surprise Knowledge Behind Thriving Guaranty Bonding Firms.

Uncovering The Surprise Knowledge Behind Thriving Guaranty Bonding Firms.

Blog Article

Write-Up Composed By-Lundgreen Stage

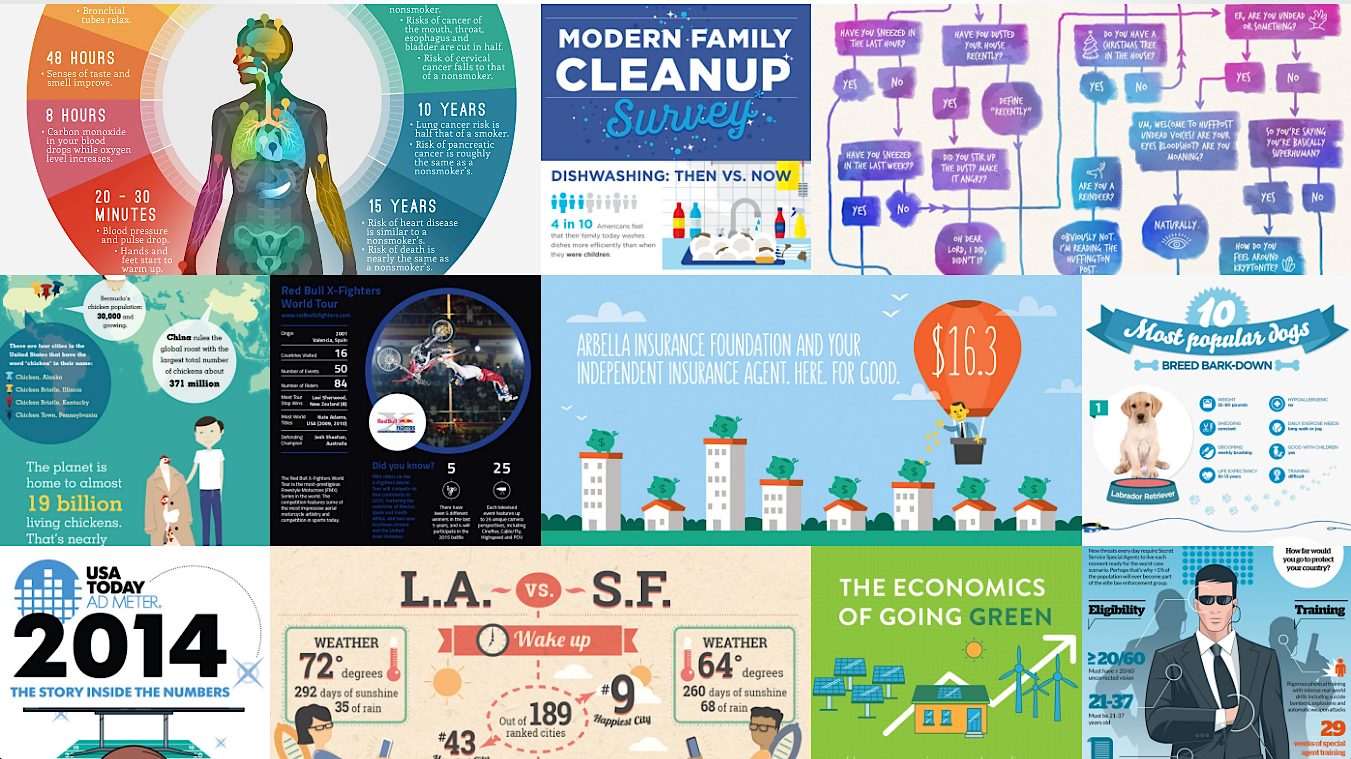

Picture disclosing the concealed secrets of prosperous guaranty bonding firms. Unearth the strategies that will aid you in developing robust links with customers, incorporating creative strategies to run the risk of management, and providing reputable surety bonds.

In this short article, you will certainly discover the key aspects that contribute to the success of these companies. Get ready to unlock the secrets behind their achievements and boost your own guaranty bonding company to brand-new heights.

Strategies for Structure Strong Customer Relationships

Improving client links can be accomplished through the use of effective interaction methods.

One way to do this is by preserving open lines of communication. Regularly check in with https://archermewne.theobloggers.com/37350587/comprehending-various-kinds-of-surety-bonds-and-their-uses to see just how they're doing and if they have any kind of concerns or questions. React to their inquiries promptly and address any type of concerns that develop in a timely manner.

One more method is to personalize your communication. Make the effort to understand your customers' demands and choices, and tailor your interaction as necessary. dealer surety bond can include using their preferred technique of interaction, resolving them by name, and revealing genuine passion in their organization.

Furthermore, active listening is vital in building strong client relationships. Take notice of what your customers are claiming, ask clarifying questions, and reveal compassion and understanding.

By incorporating imaginative techniques for taking care of threats, surety bonding firms can effectively decrease possible risks and guarantee desirable results.

In today's ever-changing business landscape, it's important for surety bonding business to stay ahead of the contour and adjust to arising risks.

Furthermore, using innovation, such as electronic systems and online sites, can improve the underwriting process and improve communication with customers. This not only minimizes administrative burdens however likewise boosts transparency and performance.

Key Factors in Giving Reliable Guaranty Bonds

Among the essential factors in offering trusted surety bonds is ensuring detailed financial analysis of bond candidates. By conducting an extensive analysis of the economic wellness and stability of possible bondholders, surety bonding firms can examine the candidate's capability to accomplish their legal responsibilities.

This evaluation includes reviewing the applicant's financial statements, credit history, cash flow, and general economic stamina. It's critical to check out elements such as liquidity, debt-to-equity proportions, and profitability to gauge the candidate's ability to manage potential threat. Furthermore, evaluating the applicant's record and sector experience can supply more insights into their capability to satisfy responsibilities.

Summing up

You've untangled the surprise treasures, explored the depths of success, and discovered the mysteries of surety bonding firms.

With solid customer relationships as their structure, innovative risk monitoring methods as their assisting light, and trustworthy surety bonds as their shield of trust, these firms stand tall.

Like a symphony of harmony, they dance to the rhythm of success, leading the way for a protected future.

Currently armed with these keys, you too can conquer the world of guaranty bonding.